Cyprus has for the past years successfully attracted foreign investment by tax effective holding company regime.

With the introduction of a single European passport for securities, investors can now forum shop, for their jurisdiction of choice, to locate their holding company. The advantages for such a structure are two fold (i) it consolidates the ownership of the investments in operating subsidiaries (a tax driven exercise) in one holding company; and (ii) it allows such company to raise finance or list its shares in chosen jurisdiction.

In recent years, the competent authority of Cyprus has experienced an inflow of applications for initial public offerings, and admissions, to trading of shares by Cyprus companies, on other European capital markets, including on the London Stock Exchange, and in particular, on the main market of the Warsaw Stock Exchange.

The Attraction to the London Exchange and to the Warsaw Stock Exchange.

The London Stock Exchange is a very stable and liquid one. Listing on the London Stock Exchange means a company has access to one of the world’s deepest polls of capital and a varied investor base. It is a market which exposes companies to liquidity due to presence of both institutional and retail investors.

In recent years, the Warsaw Stock Exchange has strengthened its position as the regional financial hub and constantly attracts foreign firms doing business in Poland or across central and Eastern Europe.

The main market of the Warsaw Stock Exchange (the “Main Market”) was ranked third in the world based on the number of new listings in the first half of 2011, according to the World Federation of Exchanges.

Why list abroad via a Cyprus SPV?

Currently, no Ukrainian companies have direct listings of their shares or bonds abroad. The reason for this is the requirements and restrictions imposed by the Ukrainian competent authority in respect of issuers and the terms of their placement abroad. In particular, the shares to be listed abroad must not exceed 25% of the issuer’s registered capital. The Russian competent authority also imposes similar restrictions with a Russian company capable of listing between 5%-25% of the issuer’s registered capital.

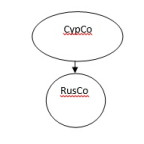

The restrictions imposed on Russian and Ukrainian issuers by their respective competent authority can be avoided by interposing a foreign holding vehicle which may act as the issuer for the Russian - based group or Ukrainian - based group respectively.

Tax benefits of a Cyprus Company

Cyprus is considered as one of the most tax efficient jurisdictions in the European Union, well-known for its low corporate income tax rate at 10%.

A Cyprus company can achieve low or zero withholding tax rates, when extracting dividends from underlying subsidiaries, by relying either, on its double tax treaty network, or on the Parent / Subsidiary Directive. Where the investment is outside the EU, Cyprus can rely on its large network of double tax treaties, the rates of which, especially as far as Eastern European investments are concerned, are considered particularly advantageous.

Cyprus taxes foreign incoming dividends at a rate of 20% but provides for a generous exemption mechanism which is almost always satisfied resulting in the non taxation of the foreign-source dividend income. There are no withholding taxes on dividend payments to non residents regardless of the country of residence of the non resident shareholder or the existence or not of a double tax treaty with such country of residence.

There is no capital gains tax in Cyprus other than on the disposal of immovable property situated in Cyprus or shares (with the exception of shares listed on a recognized stock market) representing immovable property situated in Cyprus where the rate is set at 20%.

In contrast to other jurisdictions, there are no thin capitalization rules in the Cyprus tax legislation. Therefore a Cyprus company can be entirely capitalized by loans and subject to certain conditions any arms length interest paid to a parent is fully deductible.

The Legislation

The general rules governing the requirements for (i) drawing up; (ii) obtaining approval; and (iii) the distribution of a prospectus for securities offered to the public or admitted to trading on a regulated market; are set out by Directive 2003/71/EC (the “Prospectus Directive”) and are transposed into national legislation by Law N.114(I)/2005 (the “Prospectus Law”).

The authority designated by the Cyprus government to regulate the Prospectus Law, as well as to impose administrative sanctions, is the Cyprus Securities and Exchange Commission (“CYSEC”).

In 2005, the companies law Cap. 113 (the “Companies Law”) was amended as to include the rules for drawing up a prospectus in the case of a public offering of shares and debentures where the Prospectus Law does not apply. Where a prospectus is required to be drawn up under the Companies Law, such prospectus must be filed with the Cyprus registrar of companies.

The Benefits of the Prospectus Directive / Prospectus Law

The spirit of the Prospectus Directive is to ensure investor protection and to enhance market efficiency. Due to the fact that there is a broad range of investors taking part in the securities market which have different levels of expertise, it was necessary to provide protection for those with limited knowledge and expertise. For example a prospectus is not required for offers limited to qualified investors since their level of expertise differs from that of non-qualified investors.

Information is the key to investor protection. The regulations set out by the Prospectus Directive and subsequently the Prospectus Law have harmonized the information to be contained in the prospectus in order to safeguard potential investors. The information must be sufficient in relation to the financial circumstances of the issuer, by using as much as possible an objective standard, and the rights attached to the securities should be presented in a simple comprehensive way.

Market efficiency has been achieved by the Prospectus Directive as all insurers within the European Union follow common rules, when offering securities to the public in another member state, or when admitting the securities to trading on a regulated market in another member state. The competent authorities of each member state, are also bound by common rules with regards, to deadlines and methods of checking information, contained in a prospectus.

Issuers complying with the Prospectus Directive, are granted a single passport with the opportunity to raise capital on a pan-European level.

Where the issuer is a Cyprus company, the home member state is Cyprus and the competent authority to approve a prospectus is CYSEC. Once approved, CYSEC will provide the competent authority in the member state in which the securities will be offered to the public, or admitted to trading (referred to as the host member state), a certificate confirming that the provisions of the Prospectus Directive have been fully complied with, enabling the prospectus to be used in other member states, without the need to follow additional administrative procedures.

CYSEC must at the request of the issuer, or person requesting admission to trading (as the case may be), provide the certificate to each of the host member states facilitating the cross-border IPO or listings, in each of the host member states within one or three working days.

The promptness of the competent authority of the home member state to issue a certificate to the competent authority of a host member state; and the importance of raising capital in different member states through a single passport, is part of the Prospectus Directive’s spirit.

The Rules Governing Prospectus Liability in Cyprus

Persons involved in drafting a prospectus for a Cyprus issuer should consider the responsibilities and liabilities that may arise regardless of whether a public offering will take place in Cyprus or in another member state, and regardless of whether its shares will be listed on the Cyprus Stock Exchange, or on the stock exchange of another member state.

The persons usually identified in a prospectus other than the issuer itself, or the person applying for admission for trading and the underwriter, are the advisors to the issuer, the legal counsel and auditors acting for the issuer, and the legal counsel and auditors who have conducted a due diligence on the issuer, on behalf of the underwriter. However, it is only the underwriter and the offeror, or person requesting admission to trading, that are required to sign a responsibility statement, contained in the prospectus, confirming that the information included in the prospectus is true and correct.

Under the Prospectus Law, the civil liability attaching to the persons identified in a prospectus is not equal. The liability of the underwriter under the Prospectus Law, is more limited than the liability of others, who are required to sign the prospectus, in that the underwriter’s liability is confined to the damage sustained by investors as a result of the fall in price of the securities. The liability is broad in the case of other persons required to sign the prospectus, as an investor may for example, claim damages based on the fact that he/she was not able to sell the securities and thus sustained damage, regardless of whether there was a fall in the price to the securities or not. Where the prospectus has been drawn up by more than one underwriter, each underwriter is jointly and severally liable.

If the contents of the prospectus were subject to a legal and financial due diligence examination carried out at the request of the underwriter, through independent legal advisors and auditors, there is a presumption that the underwriter is not liable for the contents of the prospectus. This presumption is capable of being rebutted, if by way of an example, it is proven that the independent auditors and/or legal advisors raised red flag issues in the due diligence report, and despite this, the underwriter proceeded with the drawing up of the prospectus without rectifying the issues raised.

The Prospectus Directive imposes a responsibility on member states to ensure that responsibility for information given in a prospectus is attached to the issuer or its management or supervisory bodies, the offerror, the person asking for admission to trading on a regulated market or the guarantor as the case may be. The Prospectus Law has gone a step further than the obligation imposed by the Prospectus Directive by also attaching civil liability to persons making statements in a prospectus within their professional capacity such as lawyers, auditors and financial advisors. Where such statements are expressed in the prospectus, the author is responsible to investors for every loss they may sustain, if the prospectus contained inaccuracies or material omissions due to deficiencies in such statements.

Amended Prospectus Directive

In an effort to simplify the rules on prospectus drafting and improve investor protection the European Parliament and European Council passed Directive 2010/73/EU amending the Prospectus Directive which came into force on 31 December 2010 (the “Amended Prospectus Directive”). Each member state must ensure that this is implemented into national law by 1 July 2012. Cyprus has not yet transposed the Amended Prospectus Directive into national legislation but in any case will meet the implementation deadline. The Amended Prospectus Directive will have important implications to issuers and investors alike once transposed into national legislation.

Some of the significant amendments include:

• The consideration threshold for an offer of securities for which a prospectus is required will be increased from €2.5 million to €5 million;

• A prospectus will not be required for offers addressed to less than 150 persons per member state (currently at 100 person under the Prospectus Directive);

• The exemption for offers of securities with a minimum consideration per investor or denomination per unit will be increased from €50,000 to €100.000;

• The expansion of the definition “Qualified Investor” (falling under the exemptions of an offer to the public thus not requiring a prospectus) now in line with the definitions for persons or entries treated as “professional clients” and “eligible counterparty” under the Markets in Financial Investments Directive;

• The Prospectus must be published on the website of the issuer, or the financial intermediary, previously an option, not an obligation.

The Amended Prospectus Directive provides that the summary of a prospectus is now required to be presented in a concise manner and include key information, which is to be provided to the investors with a view to enable them to understand the risks of securities being offered. The key information will include the following elements:

(i) a short description of the risks associated with and essential characteristics of the issuer and any guarantor including the assets liabilities and financial position;

(ii) a short description of the risk associated with an essential characteristics of the investment in the relevant security, including any rights attaching to the securities;

(iii) general terms of the offer, including estimated expenses charged to the investor by the issuer or the offeror;

(iv) details of the admission to trading; and

(v) reasons of the offer and use of proceeds.

In addition to providing the key information, the summary of all prospectuses must be drawn up in a standardized format in order to facilitate comparability of the summaries of similar securities. The particular amendment should be viewed as an enhancement of investor protection.

Cyprus Legislation Amended to Support Cross-border IPOs and Listings

Recent amendments to the Companies Law overcame practical issues which arose in cases of cross-border listings by Cyprus Companies resulting from the need to maintain a physical register of members in Cyprus. More specifically:

(i) The registration of a transfer of shares or other securities is legal even in the absence of an instrument of transfer provided, however, that such transfer has taken place in accordance with the rules of the regulated market in which the shares or securities are listed;

(ii) A Cyprus company whose shares are listed in a regulated market abroad can keep a register of members outside Cyprus in the jurisdiction of the regulated market or where the members reside, provided copies of all entries therein are sent to the registered office of the company; and

(iii) In cases of companies the shares of which are listed on a market outside Cyprus, the obligation to keep a register of members is satisfied if a register of members is maintained in accordance with the rules regulating such market which, in effect, allows for electronic register.

As cross border IPOs and listings inevitably mean the shares of Cyprus companies are held by persons who do not reside in Cyprus it became evident that a gap existed throughout the European Union as between non-resident shareholders and resident shareholders. This gap was due to the geographical obstacle for non-resident shareholders to attend the general meeting at the registered office of the relevant company and subsequent inability to exercise their voting rights.

The transposition of Directive 2007/37/EC regulating the exercise of certain rights of shareholders in listed companies into the Companies Law has rectified this situation by allowing the possibility of participating in general meetings via electronic means and the possibility of cross border voting rights of shareholders to be exercised at general meetings.

Cyprus has established its position as a competitive forum for tax purposes and further has enacted and amended laws in order to facilitate and enhance cross-border IPOs and listings by Cyprus companies. Due to the inflow of applications for single passports (in particular listings on the Main Market of the Warsaw Stock Exchange), CYSEC is now well-equipped with sufficient experience to process applications within the timeframes imposed by the Prospectus Directive and Prospectus Law.

For further information on this topic please contact Mr. Soteris Pittas at SOTERIS PITTAS & CO LLC, by telephone (+357 25 028460) or by fax (+357 25 028461) or by e-mail (spittas@pittaslegal.com).

The content of this article is intended to provide a general guide to the subject matter. Specialist advise should be sought about your specific circumstances.

![The Law amending the Companies Law CAP 113 N.4 [89(I) /2015] and collectively (the ‘Law’) came into force on 19 June 2015 and brought with it several changes to the current legal regime.](/images/thumbnails/mod_minifrontpagepro/c6952199633f1f5fbe7f4566edeaf0c2_default.jpg)