Magnumserve Group of Companies was founded on the principles of providing a new platform for the international financial industry by offering a full spectrum of consulting and administrative services.

CYPRUS: BILATERAL AGREEMENT BETWEEN CYPRUS AND THE UNITED STATES The Cyprus Tax Department announced that the bilateral Competent Authority Arrangement (CAA) for the exchange of...

Cyprus: Corporate Measures undertaken by the government in response to COVID-19 As part of the measures taken by the Cypriot government to support companies/businesses affected by the...

Cyprus -Russia. Cyprus Double Tax Treaty What will happen to Cyprus Russia Double Tax Treaty? A rather unexpected announcement by the Russian President, on 25 March 2020 made in an effort...

Security for the Loan. Fixed and Floating Charges under Cyprus Law. Charges under Cyprus law, can be of a fixed and floating nature, (i.e fixed and floating charges). Fixed and floating...

Double Tax Treaty between Cyprus and Republic of Kazakhstan On May 30th, 2018, the successful final round of negotiation within the conclusion of the negotiation of the Convention for the...

Cyprus: New Double Tax Treaty between Cyprus and Egypt On the 8th of October 2019, Cyprus and the Arab Republic of Egypt have signed a new Double Tax Treaty between them, which will update...

Cyprus: Duties and Liabilities of ‘’Nominee Directors’’ The Law Commission in its Consultation Paper on Directors’ Duties 1998 (CP 153), explained the term ‘’nominee director’’ as referring...

The 5th EU Anti-Money laundering Directive Money laundering, terrorism financing and organized crime consist significant problems, addressed at Union Level, as money launderers usually take...

Cyprus Tax Authorities introduce guidance for taxation of Intra-Group Financing Transactions. In Cyprus Transfer Pricing rules are regulated by the circular issued on 30 June 2017 by the...

Amendments to the Cyprus Investment Scheme Certain significant amendments have been made to the Cyprus Investment Scheme whereby the Government has taken a step to limit the program, even...

Cyprus Investment Program -Focus Investor’s Family Members-update May 2018 Per Council of Minister’s decisions dated, 13 September 2016, 9 January 2018 and 21 May 2018 the position as to the...

CYPRUS: Redomiciliation of Cyprus Companies to Other Countries A Cyprus company, upon obtaining the consent of the Registrar of Cyprus Companies, can apply to a foreign country to continue...

Cyprus - UK- Double Taxation Convention- Update of the Treaty of 1974 The Cyprus UK Double Taxation Convention has bene signed in Nicosia on March 22, 2018. The New Treaty is pending...

From Cypriot Citizenship by Investment Programme to Cypriot Investment Scheme The system that has been introduced in 2013 remains in full force and our previous note in this respect applies...

THE EU LIST of non-cooperative tax jurisdictions During their meeting in Brussels on the 5th December 2017, the Finance Ministers of EU Member States agreed the first ever EU list of...

CYPRUS: VAT LAW AMENDMENT On the 3rd of November 2017 the Cypriot Parliament amended the VAT Law which relates to the building land taxation in order for same to comply with the provisions of...

Cyprus: Tax residency amendment The Parliament of Cyprus has approved on the 14th of July 2017 a bill which grants tax residence status to persons who have spent at least 60 days in Cyprus...

CYPRUS: Personal criminal liability when issuing a cheque on behalf of the company A bouncing cheque (see Art. 305A Criminal Code - Chapter 154) is an offence of strict liability for its...

Cyprus: The Amendments to the Companies Law Cap 113 The House of Representatives has approved the amendment to the Companies Law Cap 113 by passing the Law 51(Ι) of 2017, which transposes the...

CYPRUS - TAX UPDATE – TAX RESIDENCY RULES TO BE AMENDED On 14th July 2017, the Parliament of Cyprus unanimously approved the bill that gives the right to an individual to be considered as tax...

The amended law on Specific Performance relating to Property Sales Recently, the law of Specific Performance relating to Property Sales of 2017 has entered into force and has amended article 12...

Cyprus- Dispute Resolution – Commercial Court Minister of Justice, Mr. Ionas Nicolaou and Members of Supreme Court had decided for the Commercial Court to be set up and become operational from the...

Cyprus – Tax –Notional Interest Deduction (the “NID”) and Circular 2016/10 The NID rules have been introduced into our legal system in 2015 and provided that the corporate entities, including...

Cyprus – Tax-Immovable Property Tax Law On 14 July 2016, the House of Representatives approved changes to the Immovable Property Tax Law (the “Law”). The amendments, which were published in the...

Cyprus – Commercial Law - Promissory Notes A promissory note is an unconditional promise made in writing by one person to another signed by the maker, engaging to pay on demand or at a fixed or...

Cyprus: The new EU Electronic Signature Regulation 910/2014/EU The EU has adopted a new Regulation which establishes a new, comprehensive, legal framework for e-signatures, as well as...

Convention between the Republic of Cyprus and Latvia A Convention, for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, has been concluded...

Cyprus: European Court of Justice importance in ruling on the Cyprus haircut case Several citizens of the Republic of Cyprus and one company which is based in Cyprus had claimed before the...

Cyprus- Health-NHS System The Cabinet approved on Friday (7.10.2016) a draft bill, concerning the establishment of the National Health System, as well as a second draft bill that provides for...

CYPRUS PRIVATISATION OF THE CSE The Cyprus Privatisation Unit has announced a tender for the appointment of a reputable independent advisor to prepare a strategic plan for the privatisation of...

Cyprus: Implementation of the EU Regulation No. 655/2014 The EU Regulation No. 655/2014 establishes a European Account Preservation procedure to facilitate cross-border debt recovery in civil...

No interest to buy loans from BoC - CySec The head of Cyprus’s Securities and Exchange Commission (CySEC) Demetra Kalogerou stated on 19 September 2016 that there has been no investor interest...

The Cabinet has approved on Tuesday (13.0916) the revised scheme for granting Cypriot citizenship to non–Cypriot entrepreneurs/investors. In statements to the press on Wednesday, 13th September...

CYPRUS: ARBITRATION – ANTI-SUIT INJUNCTION ISSUED BY ARBITRATORS The European Court of Justice (‘ECJ’) in the Gazprom Case (2015) held that anti-suit injunctions issued by arbitral...

Cyprus:Announcement by the Department of Registrar of Companies and Official Receiver in relation to the Annual Company Fee On the 16th of August 2016, the Department of Registrar of Companies...

Cyprus: Clarification on Cross border Insolvency which may be applied by the Cypriot Courts On the 24rth of October 2012 the Supreme Court of the United Kingdom handed a decision on the...

Cyprus – Tax- Announcement of the Ministry of Finance of the Republic of Cyprus Convention for the Avoidance of Double Taxation and the prevention of fiscal evasion with respect on taxes on income...

CYPRUS: The Grand Chamber of the European Court of Justice to decide on the haircut of Cyprus In due course a number of appeals will be heard before the Grand Chamber of the European Court of...

Enforcement of Judgments under the New Recast Regulation 1215/2012 and the issuance of protective measures In accordance with the New Recast Regulation 1215/2012, any judgment obtained in one...

CIRCULAR OF THE UNIT FOR COMBATING MONEY LAUNDERING PURSUANT TO THE ARTICLE 55(1)(D) OF THE PREVENTION AND SUPPRESSION OF MONEY LAUNDERING ACTIVITIES LAWS 2007-2016 To: Supervisory...

CYPRUS: JURISDICTION OF CYPRUS COURTS TO RECOGNISE AND ENFORCE FOREIGN JUDGMENTS AND FOREIGN ARBITRAL AWARDS IN CYPRUS In a recent decision of the District Court of Nicosia, it has been held...

AGREEMENT BETWEEN THE REPUBLIC OF CYPRUS AND THE FEDERAL DEMOCRATIC REPUBLIC OF ETHIOPIA –on THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON...

CYPRUS : English Court Guidance on Anti- suit Injunctions _____________________________________________________ In a recent decision of the English Commercial Court in ESSAR SHIPPING LTD –v-...

Cyprus: Implementation of the Common Reporting Standard by the Republic of Cyprus The Organisation for Economic Co-operation and Development proposed a Common Reporting Standard (CRS) for the...

CYPRUS: English Court guidance on the wording of a Freezing Order Recently the Supreme Court of the United Kingdom in the case of JSC BTA Bank v Ablyazov [2015] UKSC 64made a landmark decision...

CYPRUS : English Court Guidance on the liability of an agent – towards his principal for benefits and assets acquired during agency In a recent decision of the English Supreme Court inFHR...

CYPRUS: LEGAL PROFESSIONAL PRIVILEGE In a recent case, the Supreme Court of Cyprus (single Judge), in certiorari proceedings, decided to cancel a warrant issued against a Cyprus law firm for the...

Cyprus: The strict approach of the provisions laid under the New York Convention on the enforcement of foreign arbitral awards In the recent case of Ukrainian Vodka Company Ltd v Nemiroff...

CYPRUS: LAW APPLICABLE TO CONTRACTUAL OBLIGATIONS – ROME I REGULATION Since 17 December 2009, the EU Regulation (EC) No 893/2009 on the Law Applicable to Contractual Obligations (“Rome I...

CYPRUS: An update of the European Criminal Records Information System An efficient exchange of information on criminal convictions referred to as the European Criminal Records Information System...

CYPRUS: Enforcement of Foreign Arbitral awards under New York Convention ________________________________________________________________________ In a recent decision of a Cypriot 1st Instant...

CYPRUS : WARRANT OF SEARCH ISSUED AGAINST A LAWYER CANCELLED DUE TO VIOLATION OF LEGAL PROFESSIONAL PRIVILEGE In the recent case RE: ANTONAKIS ANDREOU & CO LLC, a Supreme Court Judge, in...

CYPRUS: English guidance on the principle of legal advice privilege A recent judgment handed by the High Court of the United Kingdom, provides useful guidance on the extent of legal advice...

Cyprus: Guidance of Cyprus Courts on issue of appointment of Lawyers by the Directors of a Company Recently, the District Court of Paphos granted a decision in relation to the appointment of a...

Cyprus: Guidance for Cyprus Courts on the duties owned by directors of a company to the shareholders In a recent decision by the High Court of the United Kingdom, the court clarified the...

Cyprus: Taxation – Amendments on the Double Tax Treaty between the Republic of Cyprus and Ukraine Representatives of the Cyprus and the Ukrainian governments have signed, in Kiev, on Friday, 11...

CYPRUS: Guidance by the Supreme Court of Cyprus on “mens rea” for bounced cheques In October 2015 the Supreme Court made a remarking judgment which overturned the decision of the First-instance...

CYPRUS: Double Tax Treaty between Cyprus and Swiss Confederation On 15th October 2015, the Double Tax Treaty between the Republic of Cyprus and Swiss Confederation had entered into force (the...

Cyprus: New Procedure for Issuing a Tax Residency Certificates Tax Department, has recently issued a circular in relation to the applications for the issuance of tax residency certificates. For...

CYPRUS: NO CAPITAL GAINS TAX FOR IMMOVABLE PROPERTIES PURCHASED UNTIL THE END OF THE YEAR 2016 By a recent amendment of the Capital Gains Tax Law, Cyprus has abolished the payment of any Capital...

Tied Agents A tied agent means a person established in a Member State, who, acting under the full and unconditional responsibility of only one Investment Firm of a Member State and, on whose...

Cyprus: Possible guidance from the English Courts on the Interpretation of jurisdiction clauses as “exclusive” During the past years English courts have been willing to interpret clauses as...

CYPRUS: WINDING OF COMPANIES – WINDING UP BY THE COURT (COMPULSORY WINDING UP)-INABILITY OF THE COMPANY TO PAY ITS DEBTS Winding up is the process by which the company’s assets are realized, the...

Cyprus: A possible amendment in the Law of Social Insurance Debtors In Cyprus over the last years around 300 people received an imprisonment sentence for debts in relation to social insurance...

Cyprus: Will the proposed amendment in relation to the reduction of Judges in Family Courts solve the real issues that affect the quick adjudication of Family cases? Due to the increased amount of...

CYPRUS: SERVICE OF COURT DOCUMENTS UNDER REGULATION (EC) 1393/2007 In a case involving service of court documents in a Member State pursuant to Regulation (EC) 1393/2007, the Supreme Court of...

CYPRUS: APPOINTMENT OF RECEIVER IN AID OF EQUITABLE EXECUTION OF CYPRUS JUDGMENT In a recent case handled by our firm, we succeeded acting on behalf of a Claimant to obtain a judgment against a...

Cyprus : Supreme Court has ruled in favour of Speed and Efficacy in the spirit of judicial cooperation In the case of Alpha Bank Cyprus Ltd v. Andrew Timothy Popple in March 2015 the Supreme Court...

CYPRUS: Strengthening protection on money laundering by the Introduction of the Fourth Anti- Money Laundering Directive Flows of illegal money can damage the integrity and stability of the...

The International Court of Arbitration of the International Chamber of Commerce to communicate reasons for its decisions The ICC Court is a leading centre for resolution services and decides...

A fight against corruption by the proposed introduction of Criminal Record Certificates for Companies Due to existing problems with regards to companies competing for the undertaking of public...

THE EXAMINERSHIP - Amendments to the Cyprus Legislation The Companies Law, Cap.113 as amended by the 89(I)/2015, 63(I)/2015 and 62(I) 2015introducedthe examinership procedure, a process attempting...

CYPRUS TAX. AMENDMENTS EXPECTED TO ARRIVE IN AUTUMN 2015. A. Income Tax Treatment of Forex It is proposed that as of 1st January 2015, exchange differences, whether losses or gains, which do...

Changes to the Inheritance process under European Succession Regulation 650/2012 The growing importance of cross border successions within the European Union and the difficulties and...

Renewal and Amendment of the Double Taxation Treaty between Cyprus and Ukraine ___________________________________________________________________________ It has been officially...

ACTIVATION OF A CIF AUTHORISATION According to Cyprus Securities and Exchange Commission’s (“CySEC”) announcement dated 9th of July 2015, the process starting from the date of granting the...

RECENT DEVELOPMENTS IN CYPRUS DTT NETWORK Cyprus- Bahrain (DTT signed in March 2015) In pursuit of strengthening the ties with all Gulf countries, on 9 March, 2015 Cyprus and Bahrain signed...

CYPRUS INVESTMENT FIRMS (CIFs) The Cyprus Investment Firms Law 144(I)/2007 provides the legal framework for the provision of investment and ancillary services as well as specific provisions...

The establishment of a New Administrative Court in Nicosia, Cyprus The legislative body of the Republic of Cyprus introduced the Law 131 (I)/2015 referred to as the Law on the...

The Approval of a Bill relating to the Sale of Loans A bill under the name “Lawregulating the activities of portfolio investor companies of 2015”, has been drafted by the Central Bank of Cyprus...

Recent Amendments to Cyprus Tax Regime On the 9th July 2015, Cyprus Parliament passed number of new laws, which purport to make Cyprus a more attractive investment destination. The Laws are...

Cyprus –Immovable Property ‘Parliament to submit law addressing the issue of Title Deeds and Hidden Mortgages’ One of the major problems that Cyprus faces throughout the years is the...

![The Law amending the Companies Law CAP 113 N.4 [89(I) /2015] and collectively (the ‘Law’) came into force on 19 June 2015 and brought with it several changes to the current legal regime.](/images/thumbnails/mod_minifrontpagepro/c6952199633f1f5fbe7f4566edeaf0c2_default.jpg)

The Law amending the Companies Law CAP 113 N.4 [89(I) /2015] and collectively (the ‘Law’) came into force on 19 June 2015 and brought with it several changes to the current legal...

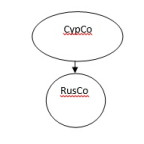

Deoffshorization Law in Russia and possible solutions for the CFCs in Cyprus The Federal Law No 376-FZ dated 24 November 2014 “Concerning the Introduction of Amendments to Parts One and Two of...

NOTE ON SHORT/LONG RESIDENCY AND NATURALISATION OF INVERSTORS I. TEMPORARY RESIDENCE PERMIT- Uniform Biometric Card On 29 September 2014 the Law has been amended...

WHERE DOES MANAGMENT AND CONROL LIE? This short note is dedicated to the test of residency in Cyprus for the purposes of taxation. It should be kept in mind that the test of...

ASSET PROTECTION & CYPRUS INTERNATIONAL TRUSTS A. WHAT DOES ASSET PROTECTION MEAN?Asset protection is the adoption of advance planning strategies which place, in a legal and...

Cyprus and Ukraine sign a new bilateral tax agreement for the avoidance of double taxation and the prevention of fiscal evasion that when in force will replace the existing Tax Bilateral tax...

Cyprus has for the past years successfully attracted foreign investment by tax effective holding company regime. With the introduction of a single European passport for securities, investors can...

Cyprus Companies are in wide use as major vehicles in international tax structuring mainly due to the broad range of legal and tax related benefits they can offer because of the flexible tax system...

Directors exercise extensive powers in the management of their companies, influencing their company’s conduct, by virtue of their involvement in the decision making process. Under Cyprus law, the...

What is a Shareholder’s Agreement? A Shareholder’s Agreement is distinct from the company’s constitution. Without a Shareholder’s Agreement, the Company would be controlled solely and exclusively...

OPEN-ENDED UNDERTAKINGS FOR COLLECTIVE INVESTMENT IN TRANSFERABLE SECURITIES (“UCITS”) 1.1 UCITS The UCITS law 200(1)/2004 (“the Law”) which implements the EU directives provides the legal...

The OPEN-ENDED FUNDS or OPEN-ENDED UNDERTAKINGS FOR COLLECTIVE INVESTMENT IN TRANSFERABLE SECURITY (“UCITS”), are regulated by the Law 200(1)/2004.The Closed-Ended Funds or International Collective...

I. INTRODUCTION The use of a large number of Cypriot Companies as vehicles for carrying out joint ventures, led JV Partners to enter into Shareholders Agreements or JV Agreements, sometimes,...

I. INTRODUCTION Cyprus is an ideal place for direct investments, because of inter alia, its strategic position, its excellent infrastructure, its favourable tax regime, its well trained labour, as...

PREFACE This brief guide has been prepared to provide a general background to the legal framework regulating the incorporation, administration and tax liabilities of the Cyprus holding company.As...

A new Double Taxation Agreement has been added to the wide network of double taxation treaties which Cyprus has with a large number of countries.On the 12th October 2010, the Republic of Cyprus...

A new Double Taxation Agreement has been added to the wide network of double taxation treaties which Cyprus has with a large number of countries.On the 5th October 2010, the Republic of Cyprus...

Magnumserve Group of Companies was founded on the principles of providing a new platform for the international financial industry by offering a full spectrum of consulting and administrative services.

Our privacy policy explains how we respect the privacy of our website users. It defines what information we gather, how we use it and how we keep it secure. Soteris Pittas & Co LLC is committed to ensuring that your privacy is protected.

Read our Privacy Policy